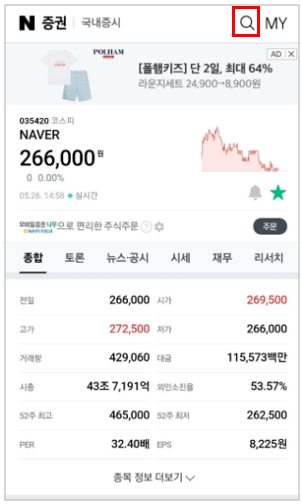

The more you look into it, the more you look for economic information that can be used without risk, and those who have been looking for KEB and Hana BankWhen you suddenly get a lot of money or the interest rate on borrowed loan products is high, you can easily replace them with conditions that you can get if you are aware of financial information in detail. However, as the majority of people hesitate to look into the details because it is complicated, and the number of people who are financially burdened by not being aware of the problems that can be improved is increasing, we will organize the basic financial information today. In addition, if you look closely, financial institutions can be used not only as living funds but also as financial resources, so if you have a plan, please read it carefully.I will tell you about the information that you should look at first before looking into everything from one to ten, such as KEB and Hana BankMost of the differences between the first financial sector, where commercial banks are concerned, and the second financial sector, where insurance companies and securities firms belong, are interest rates, but the low interest rates alone do not seem much better. In the first financial sector, the repayment burden can be significantly lowered due to approval at 3.80% interest rate, but it is difficult to get a large amount because the limit is only 65% of the annual salary. If you go to the second financial sector, the credit loan rate is about 14.69% but the limit is more than 2.5 times that of the first financial sector. And since the results of the loan screening are determined by each credit rating, you should first consider the source of the loan fund and select the product, then decide which one to take first within the interest rate and loan limit, and focus on solving the problems you face.Let me explain the easy-to-use loan products for ordinary people, KEB, and Hana Bank.If credit is too bad or it is difficult to borrow surplus funds from general banks due to personal rehabilitation or bankruptcy applications, there is also a way to use products supervised by the government, so you don’t have to hesitate. Although it is approved at the welfare level for ordinary people who do not have assets or have a lot of expected loans and interest rates, interest rate discounts can also be used more than 1.1% depending on creditworthiness, and the loan limit is more than 7 million won and the repayment period is up to 11 years. I’d like to give you more information about the policies of the common people in other sentences.For those who are looking for investment and loans, KEB or Hana Bank that will increase profitsIn addition, the size of the financial sector has increased due to the constant increase in financial technology using a small amount of money, and in the case of real estate, the limit ratio varies by 65% depending on the location of adjustment/non-adjustment areas and speculation. However, the loan limit is determined by the housing market subject to collateral, so transactions should carefully consider the fluctuation rate and the floating rate rate. In addition, there are cases where loans are used to prepare about 17 million won and enter stock investment to see profits exceeding 5.5% interest rates, but the risk may increase depending on the market situation, so you should carefully consider it.Please make one hour at a time and study.For those who want to know about Korea Exchange Bank and Hana BankIn order to lead the way with effective notification in modern society, it is good to watch the flow of money in advance in order to borrow livelihood funds or raise funds necessary for investment or financial technology. In addition, it should be carefully approached and used in a useful way as the acceptance of information and hasty choices can soon be made with tens of millions of won in debt. Even if you don’t have cash, you can make profits and repay them through stocks by repaying only interest during the repayment period, and if you only know the core of the loan, you can participate in real estate investment in overheated speculation areas without my large sum. Just as there is a financial difference between receiving the same loan at 4% interest rate and being approved at 15% excess, the point is to reduce risks according to your conditions and use good loans as if they were yours.Previous image Next imagePrevious image Next imagePrevious image Next image